Congress has lower than two years to forestall taxA tax is a compulsory fee or cost collected by native, state, and nationwide governments from people or companies to cowl the prices of common authorities companies, items, and actions.

hikes on the overwhelming majority of Individuals from going down. That’s as a result of the Tax Cuts and Jobs Act (TCJA) of 2017, a tax reform regulation that simplified particular person earnings taxes and lowered tax charges throughout the earnings spectrum, is ready to run out. If Congress does nothing, most Individuals will face larger taxes, worse incentives for work and funding, and a extra difficult tax system beginning in 2026.

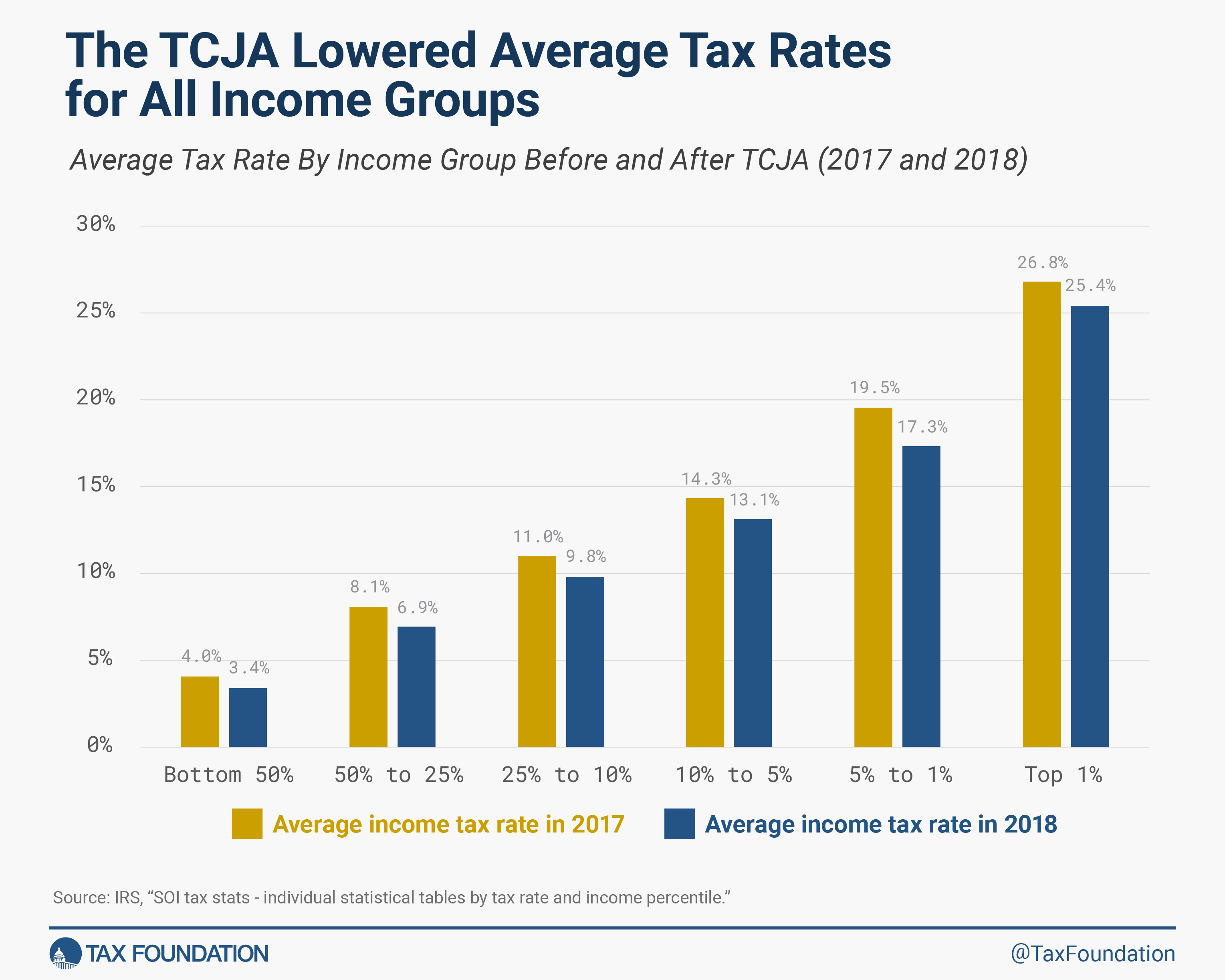

The TCJA lowered common tax charges for taxpayers in any respect earnings ranges as a result of it lowered marginal tax charges, widened tax brackets, doubled the little one tax credit score and zeroed out private and dependent exemptions, almost doubled the normal deductionThe usual deduction reduces a taxpayer’s taxable earnings by a set quantity decided by the federal government. It was almost doubled for all courses of filers by the 2017 Tax Cuts and Jobs Act (TCJA) as an incentive for taxpayers to not itemize deductions when submitting their federal earnings taxes.

, and restricted a number of itemized deductions and the various minimal tax, amongst different modifications. Though not each change the TCJA made was a tax lower—as an illustration, putting a $10,000 cap on itemized deductions for state and native taxes paid elevated taxable earningsTaxable earnings is the quantity of earnings topic to tax, after deductions and exemptions. For each people and companies, taxable earnings differs from—and is lower than—gross earnings.

for higher-income taxpayers dwelling in high-tax states—the web impact of all modifications taken collectively was to scale back common tax burdens.

In 2017, the 12 months earlier than the brand new tax modifications took impact, the underside half of taxpayers paid an common tax priceThe typical tax price is the full tax paid divided by taxable earnings. Whereas marginal tax charges present the quantity of tax paid on the subsequent greenback earned, common tax charges present the general share of earnings paid in taxes.

of 4.0 p.c. After the TCJA took impact in 2018, the typical tax price for the underside half dropped to three.4 p.c. Likewise, the typical tax price paid by the highest 1 p.c of taxpayers decreased from 26.8 p.c in 2017 to 25.4 p.c in 2018. Common charges declined throughout all earnings teams and have remained beneath their 2017 ranges since. Additional, we estimate making the person provisions of the TCJA everlasting would scale back taxes for about 62 p.c of filers, go away taxes unchanged for about 29 p.c, and improve taxes for slightly below 9 p.c of filers in 2026.

Our tax calculator instrument helps reveal how the expiration or extension of the TCJA might have an effect on taxpayers in several eventualities in 2026. The calculator permits customers to check how completely different pattern taxpayers fare or to enter a customized taxpayer.

The tax calculator compares tax legal responsibility underneath two eventualities for tax 12 months 2026. First, the calculator exhibits a taxpayer’s legal responsibility if Congress extends the TCJA. Subsequent, the calculator exhibits a taxpayer’s legal responsibility if Congress does nothing and permits the TCJA to run out. The distinction between the 2 illustrates the tax improve (or, in uncommon instances, lower) a taxpayer would see if the TCJA expires. Share this instrument: taxfoundation.org/calculator.

In regards to the Tax Calculator

The calculator contains most elements of the federal particular person earnings taxA person earnings tax (or private earnings tax) is levied on the wages, salaries, investments, or different types of earnings a person or family earns. The U.S. imposes a progressive earnings tax the place charges improve with earnings. The Federal Earnings Tax was established in 1913 with the ratification of the sixteenth Modification. Although barely 100 years previous, particular person earnings taxes are the largest supply of tax income within the U.S.

code besides provisions associated to enterprise and self-employed earnings.

The Tax Basis’s tax calculator is meant as an illustrative instrument for the estimation of the TCJA’s influence on instance taxpayers. It doesn’t absolutely symbolize all potential tax eventualities and liabilities and shouldn’t be used for tax preparation functions. The tax calculator is for instructional use solely.

Keep knowledgeable on the tax insurance policies impacting you.

Subscribe to get insights from our trusted specialists delivered straight to your inbox.

Share