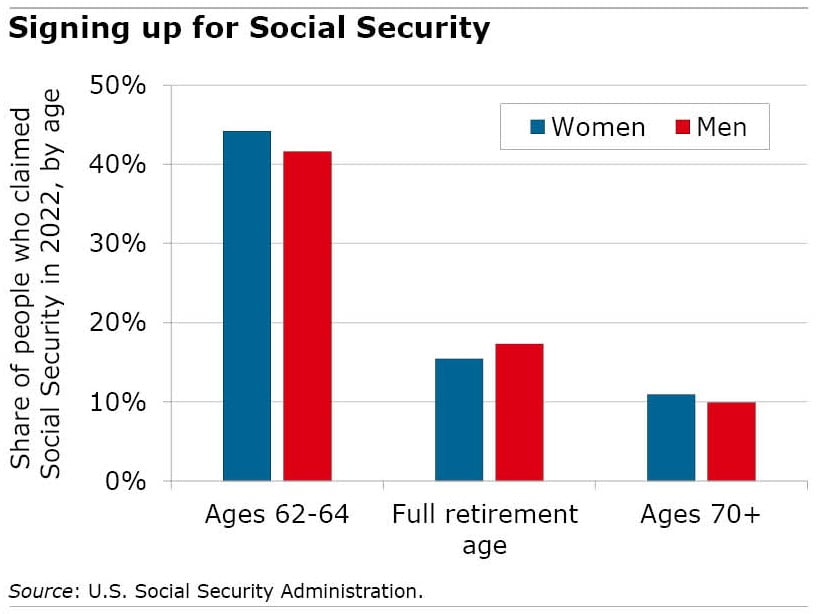

Monetary advisers typically encourage older employees to delay signing up for his or her Social Safety so long as potential to maximise their month-to-month earnings.

However a number of of our weblog’s readers level out, rightly, that this isn’t at all times potential for folks in bodily taxing jobs. Blue-collar employees are in an actual Catch-22, caught between the unforgiving monetary calls for of retiring and a physique that may’t take any extra work.

“That’s me,” a reader named George L. commented on a latest weblog, “The Psychology Behind Beginning Social Safety at 62.” Psychology had little to do along with his determination to begin Social Safety. “I labored unskilled arduous labor all my life so I used to be able to retire at 62,” he mentioned.

One other reader, Ellis, mentioned he is aware of retired linemen, building employees and truck drivers.

“They have been simply worn out by 62, and persevering with to work of their occupations can be exceedingly taxing and harmful because of declining talents,” he mentioned. “Work like that may take years off a life.”

However for an additional reader, monetary safety – his spouse’s – was the first consideration in deciding when to begin Social Safety. David Scarborough mentioned he earns greater than his spouse and desires to verify she has a big sufficient spousal profit from his Social Safety since “I’m fairly prone to die earlier than she does.”

It’s, he mentioned, “in each of our pursuits for me to delay claiming.”

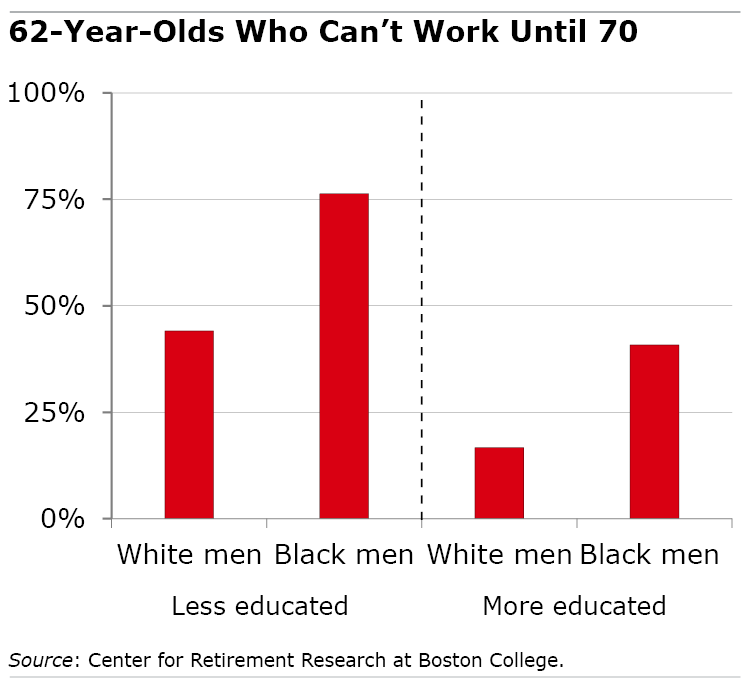

Analysis reveals that how a lot somebody earns is an enormous think about after they determine to retire. Individuals in bodily demanding jobs, who could really feel they’ll’t work any longer, additionally are inclined to earn much less and may need quite a bit to achieve from delaying their advantages – if solely they may. Staff who’ve the posh of delaying are sometimes in comparatively comfortable or high-paying workplace jobs or are doing work that energizes them, quite than sporting them out.

“It’s straightforward for an accountant or librarian to remain working full-time till 70,” Dr. Edward Hoffer mentioned, “however not really easy for a roofer or custodian.”

A 2021 research revealed this deep socioeconomic hole, which runs alongside racial strains. Just one out of 5 college-educated White males wouldn’t be bodily in a position to work till 70. On the different finish of the spectrum, three out of 4 less-educated Blacks couldn’t make it that lengthy.

Though readers centered on the monetary points concerned, some acknowledged one psychological side of deciding when to begin Social Safety: the expectation of how lengthy they are going to stay.

The analysis featured on this weblog reveals that individuals who anticipate to stay longer delay claiming their advantages. The distinction is with individuals who maintain the other view – that “life is brief” – and really feel that it’s necessary to seize the advantages as quickly as potential and luxuriate in their retirement years.

“I’ve seen sufficient of my friends/household cross away of their 60s and 70s,” mentioned Deanna, one other reader.

The best way Social Safety’s components works is that the bigger checks a retiree receives by delaying will, in the event that they stay lengthy sufficient, finally make up for the “misplaced” years of advantages brought on by ready. Yearly of delay will improve the scale of that month-to-month profit test by 7 p.c to eight p.c, which is substantial. Claiming at age 62 or 64 to take pleasure in retirement has a steep monetary value for folks with common or above-average life expectancy.

Brian Krech and his spouse plan to separate the distinction. Krech, who mentioned he has severe well being points, plans to begin his advantages early. His spouse will wait till 70.

“If you’re comparatively wholesome and longevity runs in your loved ones, it’s a no brainer to carry off and declare at 70 to maximise your advantages,” he mentioned.

However that is an choice that wouldn’t work for different {couples}. First, the Kreches each have comparable earnings, eliminating the difficulty of needing to maximise the spousal profit – in distinction to the reader who earns greater than his spouse. And Krech’s spouse apparently has the type of job that permits her to delay Social Safety – in distinction to getting older blue-collar employees who battle to maintain up with the bodily calls for of their jobs.

“Every private and household state of affairs is so totally different that it’s essential to take a look at all choices and rationale earlier than claiming your Social Safety advantages,” Krech mentioned.

Each employee’s state of affairs is totally different. However the potential to work longer can also be an enormous a part of the equation.

To learn the research by Suzanne Shu and John Payne, see “Social Safety Claiming Intentions: Psychological Possession, Loss Aversion, and Data Shows.”

The analysis reported herein was derived in complete or partly from analysis actions carried out pursuant to a grant from the U.S. Social Safety Administration (SSA) funded as a part of the Retirement and Incapacity Analysis Consortium. The opinions and conclusions expressed are solely these of the authors and don’t signify the opinions or coverage of SSA, any company of the federal authorities, or Boston Faculty. Neither the US Authorities nor any company thereof, nor any of their staff, make any guarantee, specific or implied, or assumes any authorized legal responsibility or duty for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any particular industrial product, course of or service by commerce title, trademark, producer, or in any other case doesn’t essentially represent or suggest endorsement, advice or favoring by the US Authorities or any company thereof.