Preserving consumption within the short-term means much less sources for the long run.

We simply launched a examine that introduces behavioral responses when wanting on the impact of inflation on consumption and wealth of close to retirees and retirees. The behavioral responses come from a brand new survey that explores how older households reacted to current inflation – when it comes to labor provide, saving, withdrawals, and asset allocation.

The authentic examine estimated the affect of inflation on the funds of close to retirees (head ages 55-62) and retirees (head ages 62 and older) from 2021 to 2025 beneath various macro-economic situations, together with “Smooth Touchdown” and “Recession.” It centered on two metrics: 1) the actual change in consumption from the start of the evaluation interval to the tip; and a couple of) the inventory of family wealth (monetary and housing) on the finish of the interval.

The query is how behavioral responses would possibly have an effect on the unique findings. Since financial concept is ambiguous on this concern, the authors undertook a brand new survey fielded by Greenwald Analysis in November 2023, which included 1,501 respondents ages 55-85. The most important responses to inflation concerned saving and withdrawals; only a few respondents reported altering their labor provide or asset allocation. The outcomes confirmed that 39 p.c of close to retirees modified their saving due to inflation. Amongst these primarily motivated by inflation, annual saving declined by $4,065, on common, or 4 p.c of annual family earnings in 2023. By way of withdrawals, the outcomes for close to retirees and retirees had been mixed as a result of they’re fairly related. Twenty-three p.c of respondents modified their withdrawals from 2021 to 2023 due to rising costs. Amongst these making modifications, the common enhance was $3,620 (5 p.c of 2023 family earnings).

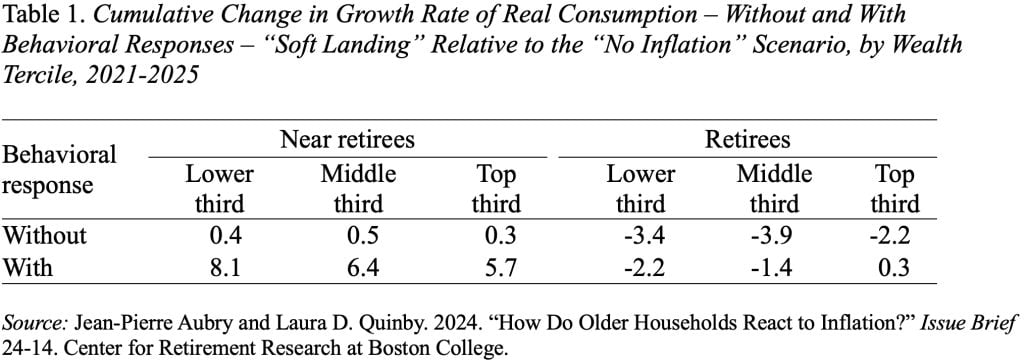

Desk 1 exhibits the distinction within the development price of actual consumption, from 2021 to 2025, for the “Smooth Touchdown” relative to the “No Inflation” state of affairs with out and with behavioral responses. Unsurprisingly, households are capable of quickly enhance consumption by tapping into their financial savings. The important thing distinction in outcomes right here is between close to retirees – who all present positive factors in consumption – and retirees – who primarily see small declines.

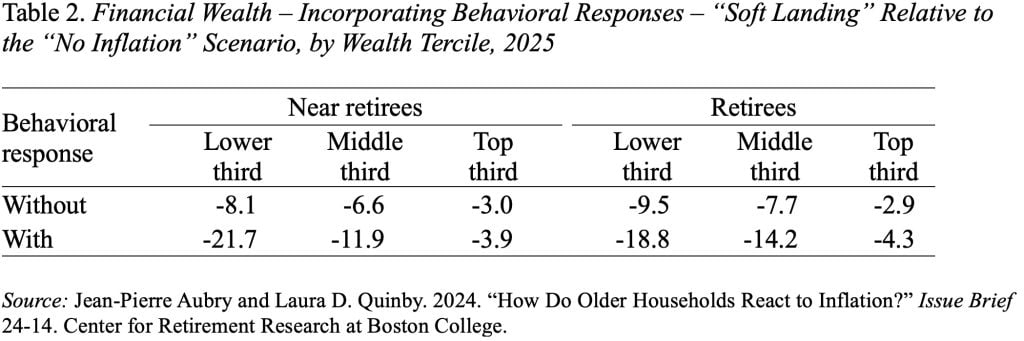

This short-term achieve, nevertheless, comes on the expense of future consumption (see Desk 2). As anticipated, diminished saving and elevated withdrawals compound the direct affect of inflation on wealth.

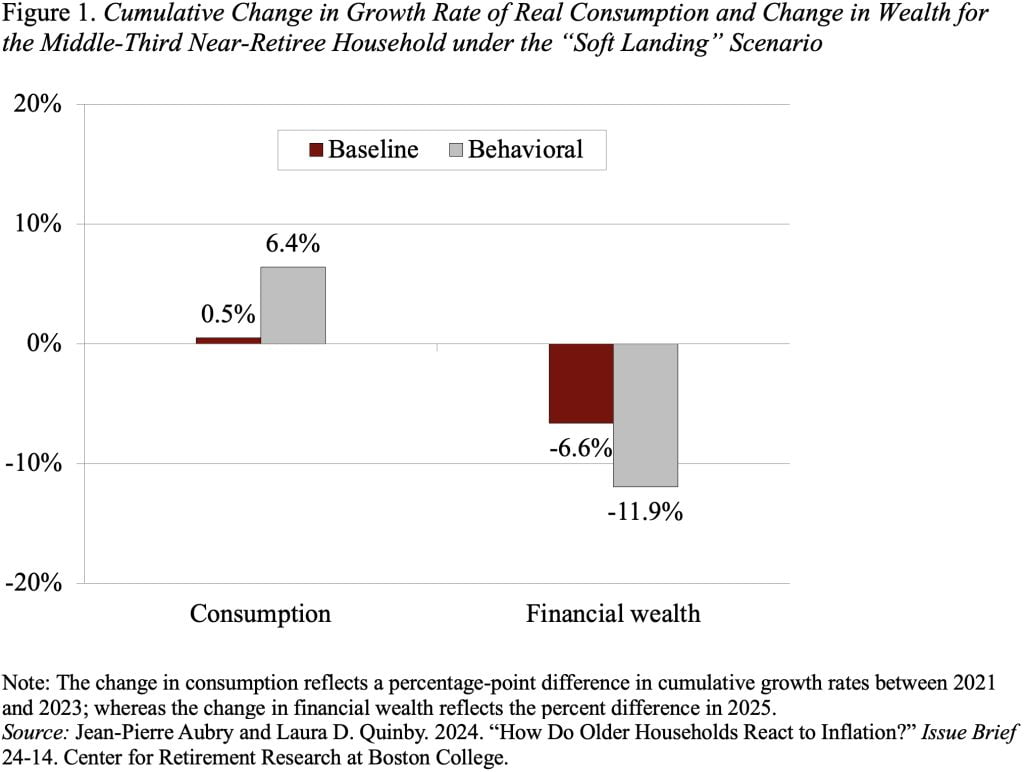

To obviously illustrate this trade-off between present and future consumption, Determine 1 compares the outcomes incorporating the behavioral responses to the unique baseline evaluation for one kind of family: close to retirees within the middle-wealth tercile beneath the “delicate touchdown” state of affairs. This identical trade-off holds throughout all age teams, wealth terciles, and macroeconomic situations.

The query that is still is whether or not the depletion of belongings is everlasting or short-term. Will households reverse course as wage positive factors exceed inflation and price range pressures recede?