When taxpayers promote their capital property, like actual property or their shares in an organization, web earnings on these gross sales (capital features) are typically topic to taxA tax is a compulsory fee or cost collected by native, state, and nationwide governments from people or companies to cowl the prices of normal authorities providers, items, and actions.

, and web losses on these gross sales (capital losses) can typically be deducted from earnings when calculating earnings tax legal responsibility.

One main shortcoming of present coverage, nevertheless, is that when calculating the capital acquire from the sale of an asset, the unique buy value (tax foundation) is expressed in nominal phrases when subtracted from the promoting value. As a result of no inflationInflation is when the overall value of products and providers will increase throughout the financial system, lowering the buying energy of a foreign money and the worth of sure property. The identical paycheck covers much less items, providers, and payments. It’s generally known as a “hidden tax,” because it leaves taxpayers much less well-off as a result of increased prices and “bracket creep,” whereas growing the federal government’s spending energy.

adjustment is made to the unique buy value, capital features taxes are utilized to nominal, not actual, will increase in wealth, which means taxpayers are taxed on what is usually a mixture of actual and fictitious earnings (though the tax code does present just a few lodging, resembling for qualifying gross sales of owner-occupied properties and properties transferred to an inheritor). In some circumstances, this lack of inflation indexingInflation indexing refers to automated cost-of-living changes constructed into tax provisions to maintain tempo with inflation. Absent these changes, earnings taxes are topic to “bracket creep” and stealth will increase on taxpayers, whereas excise taxes are weak to erosion as taxes expressed in marginal {dollars}, slightly than charges, slowly lose worth.

of the tax foundation leads to taxpayers paying taxes on what seems on paper to be a capital acquire however, as a result of inflation, is, in actual phrases, a web loss.

The federal tax code acknowledges this shortcoming with a needed, albeit imperfect, resolution. Lengthy-term capital features, outlined as web features on property held for a couple of 12 months, are taxed below a price schedule that differs from the one utilized to atypical earnings, with decrease charges than are utilized to atypical earnings. Particularly, relying on a taxpayer’s total taxable earningsTaxable earnings is the quantity of earnings topic to tax, after deductions and exemptions. For each people and firms, taxable earnings differs from—and is lower than—gross earnings.

, a price of both 0 p.c, 15 p.c, or 20 p.c applies to all their taxable long-term capital features.

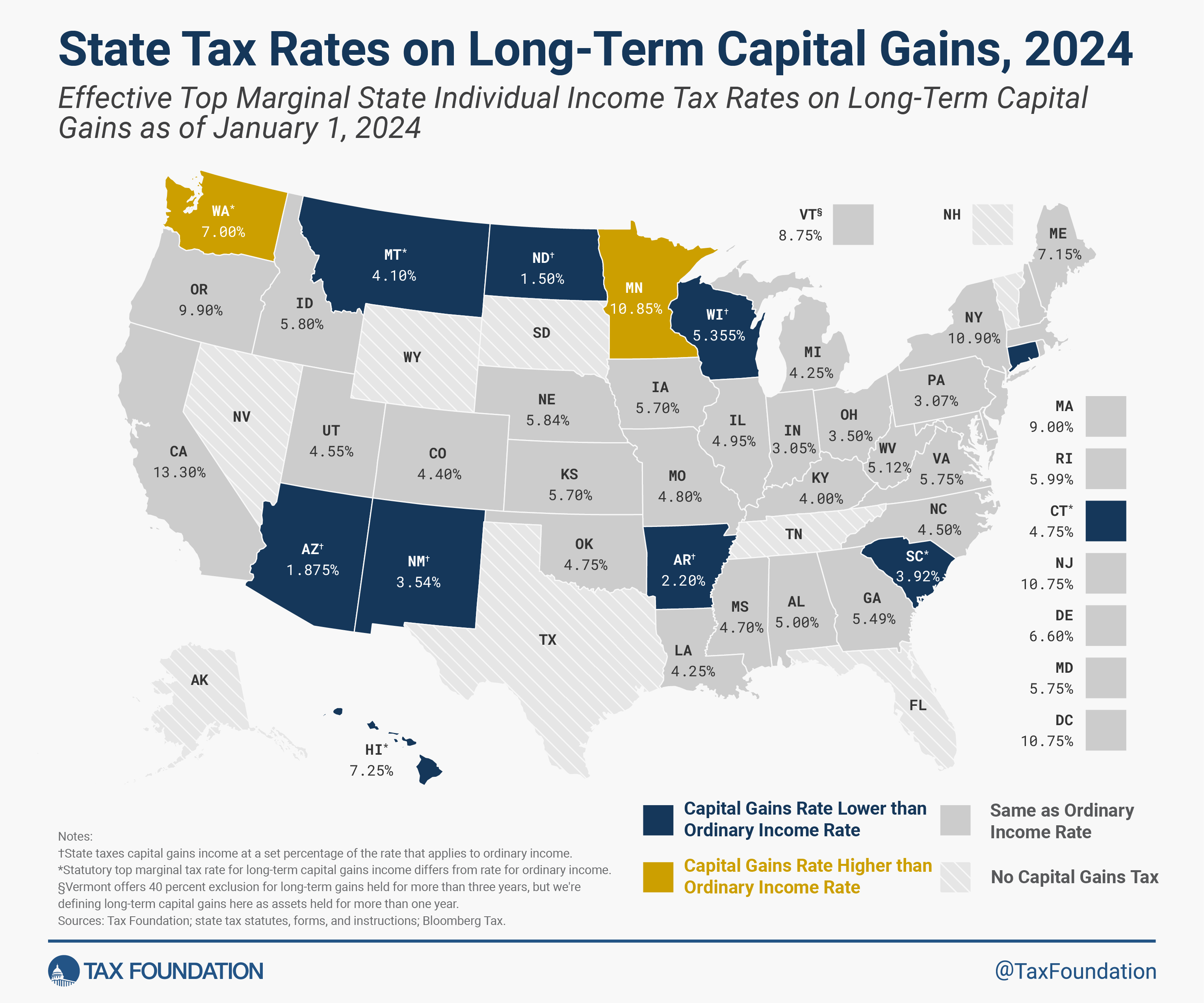

Related lodging for the results of inflation are presently far much less frequent on the state degree. Thirty-one states and the District of Columbia overtax capital features earnings just by subjecting capital features to the identical price schedule that applies to atypical earnings. Additional, two states—Minnesota and Washington—expose some capital features to increased charges than apply to atypical earnings. Particularly, Minnesota taxes most capital features at atypical charges however levies a further 1 share level tax on web funding earnings exceeding $1 million. Washington imposes a 7 p.c tax on capital features earnings exceeding $250,000, however the state doesn’t tax atypical earnings.

Solely 9 states, just like the federal authorities, apply decrease efficient particular person earnings taxA person earnings tax (or private earnings tax) is levied on the wages, salaries, investments, or different types of earnings a person or family earns. The U.S. imposes a progressive earnings tax the place charges enhance with earnings. The Federal Earnings Tax was established in 1913 with the ratification of the sixteenth Modification. Although barely 100 years previous, particular person earnings taxes are the largest supply of tax income within the U.S.

charges to long-term features than to atypical earnings, both by making use of decrease statutory charges or by providing an exclusion for a portion of in any other case taxable capital features. In the meantime, seven states keep away from this dilemma by forgoing a person earnings tax altogether, and New Hampshire, uniquely, presently taxes curiosity and dividends earnings however doesn’t tax atypical earnings or capital features earnings.

On the state degree, making use of decrease charges to long-term capital features earnings is an effective first step to assist compensate for the truth that capital features taxes apply to nominal, not actual, capital features. As such, extra states ought to contemplate becoming a member of the 9 that presently apply decrease efficient charges to long-term capital features, both by making use of a decrease price to long-term capital features earnings or offering an exclusion for a sure share of in any other case taxable capital features. Moreover, states must also guarantee they supply strong and well timed deductions for capital losses.

You will need to be mindful, nevertheless, that even when decrease price schedules or exclusions are granted, capital features taxes are however a type of double taxationDouble taxation is when taxes are paid twice on the identical greenback of earnings, no matter whether or not that’s company or particular person earnings.

. As an example this, think about a person who decides to avoid wasting for the longer term by buying inventory in an organization. Generally, these shares are bought by tax-advantaged funding accounts, like a 401(okay) or IRA, guaranteeing a taxpayer’s invested earnings is taxed solely as soon as, both on the best way in (Roth accounts) or on the best way out (conventional accounts).

Oftentimes, nevertheless, buyers buy inventory utilizing atypical wage or wage earnings that has already been taxed below the usual federal and state particular person earnings tax price schedules. Underneath favorable circumstances, over time, a taxpayer’s preliminary funding will develop. However most progress is the results of company earnings that can have already been topic to company earnings taxes by the point they attain the investor within the type of curiosity or dividends earnings, so these returns to the investor will probably be smaller than they might have been within the absence of federal and state company earnings taxes. Years or many years later, when the investor sells their shares and realizes their features, that earnings will probably be taxed once more, primarily based on its nominal, slightly than actual, progress. Whereas making use of decrease charges to realized capital features helps offset among the results of inflation that occurred between when these capital property had been purchased and bought, it doesn’t change the truth that, typically, the earnings acquired by the taxpayer may have already been lowered by the company earnings taxA company earnings tax (CIT) is levied by federal and state governments on enterprise earnings. Many corporations usually are not topic to the CIT as a result of they’re taxed as pass-through companies, with earnings reportable below the particular person earnings tax.

.

At face worth, decrease charges on long-term capital features earnings can seem like a type of preferential tax remedy, however when inflation and different layers of taxes are considered, it’s simple to see why that notion is misguided. When evaluating the tax remedy of funding earnings, state policymakers ought to contemplate all layers of taxes on these earnings, together with company earnings taxes, and perceive how the failure to inflation index the tax foundation, mixed with most states’ failure to regulate charges accordingly, leads to the widespread overtaxation of capital features earnings within the United States.

Financial savings and funding are important actions, each for people’ and households’ monetary safety and for the well being of the nationwide financial system as a complete. As such, policymakers ought to contemplate how they may help mitigate—slightly than add to—tax codes’ biases in opposition to saving and funding.

Keep knowledgeable on the tax insurance policies impacting you.

Subscribe to get insights from our trusted consultants delivered straight to your inbox.

Share